Unity of legacy and modern systems

Financial services and banking processes in the new age of technology and AI

Challenges in Financial Services and Banking

Financial services and traditional banks face critical challenges with the rise of FinTech companies and the strict regulations...

Legacy systems

Up to 40 year old IT systems in financial services and banking hinder the competitiveness and modernization.

FinTech companies

Customer-centric solutions which disrupt traditional business models and increase competitive pressure.

High data sensitivity

Extremely sensitive user data highly regulated by the authorities prevents innovation and advancement.

Regulatory compliance

Financial services industry is subject to numerous regulations regarding the handling of IT implementations.

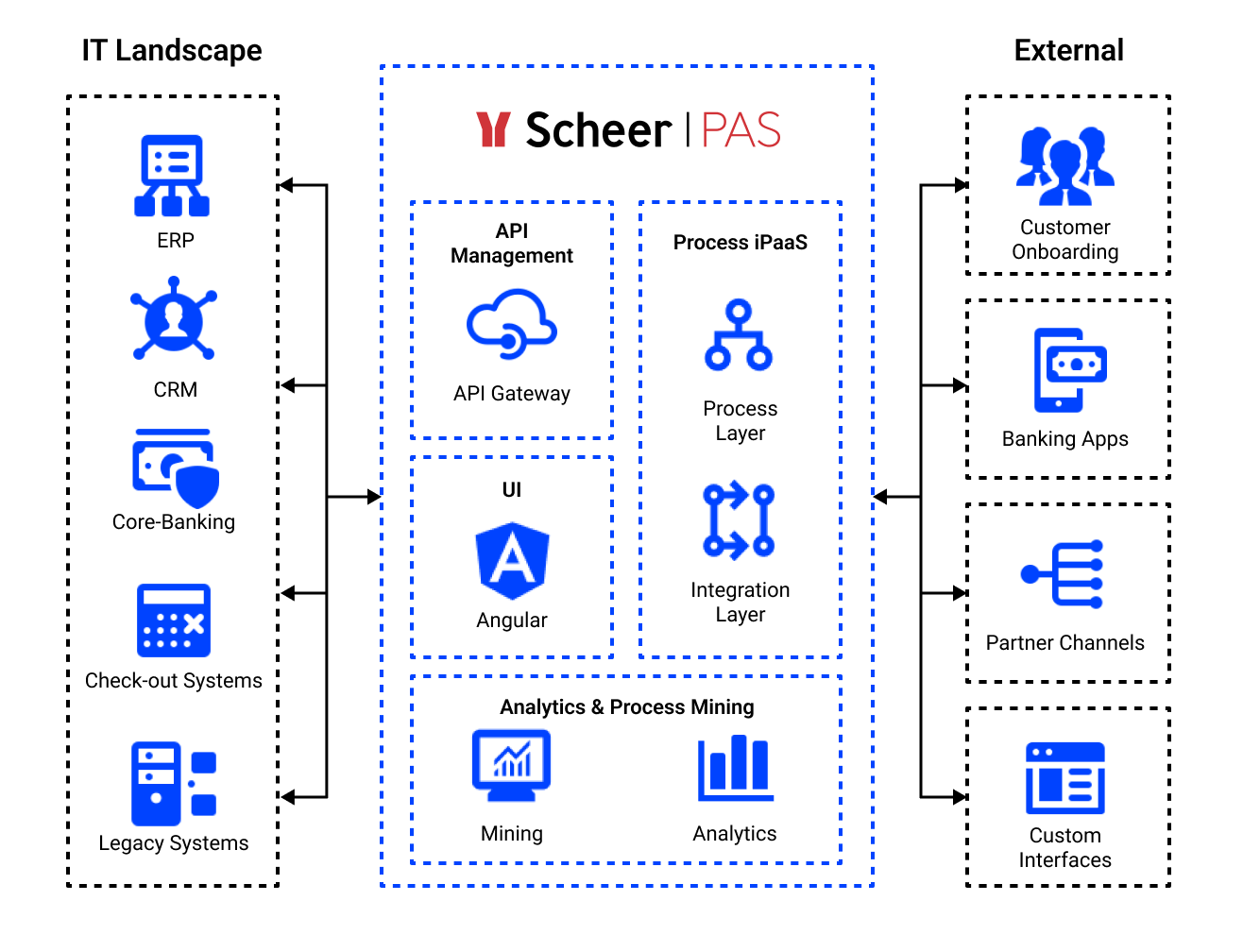

The Scheer PAS

Solution

Process iPaaS provides solutions specifically tailored to the financial services industry and banking!

Enhancing FSI with

Scheer PAS

Solving problems such as:

- Core banking system integration

- Legacy system integration and modernization

- Anomaly detection

- Financial process automation and optimization

- Streamlined compliance regulation

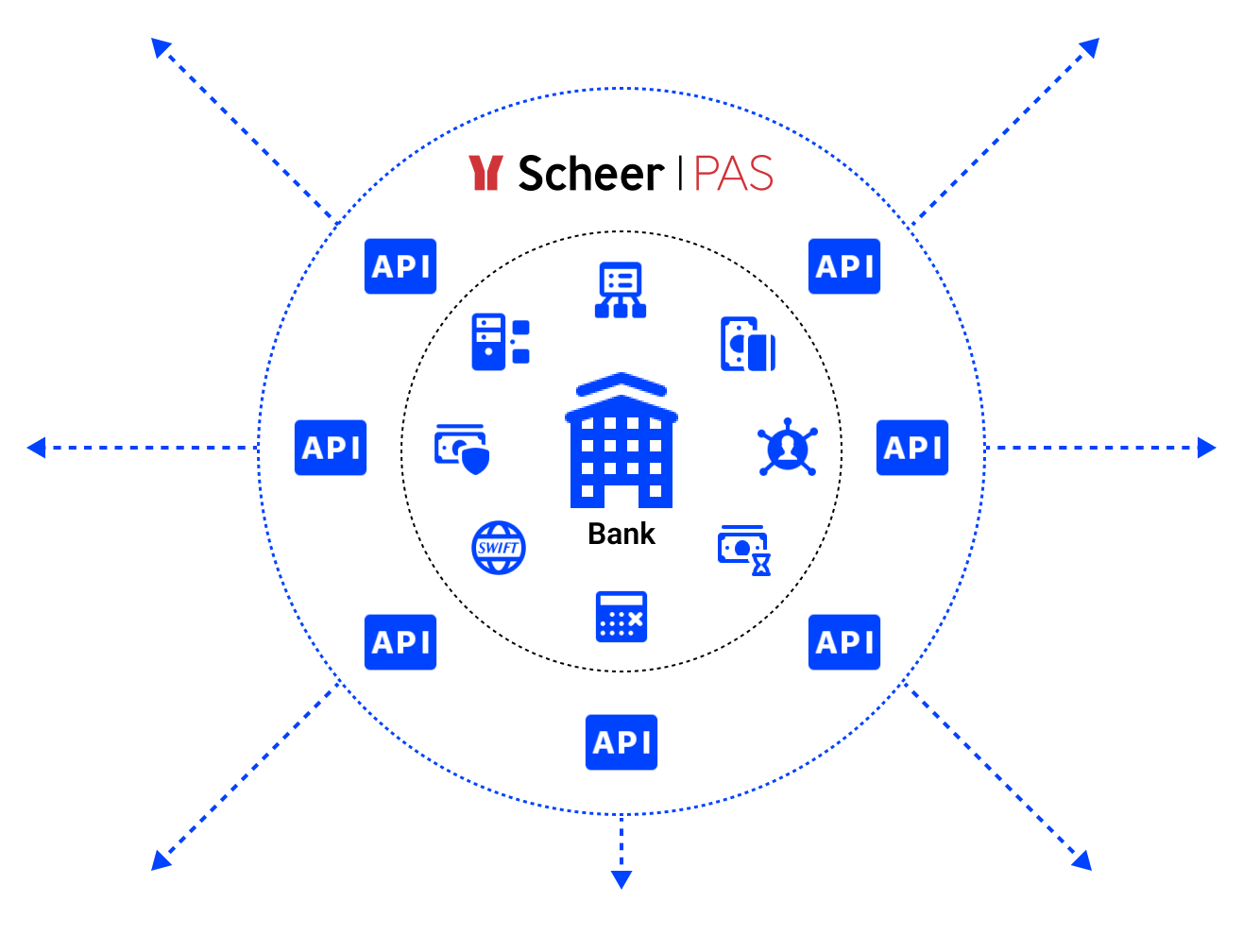

Scheer PAS

Open Banking

Integrating existing IT systems with Scheer PAS and leveraging its API Management capabilities, enables seamless connection to third party applications and services.

Leveraging Scheer PAS in FSI

Customer Onboarding and KYC Automation

Loan and Mortgage Application Processing

Fraud Detection and Prevention

Investment and Wealth Management Platforms

Regulatory Compliance and Reporting

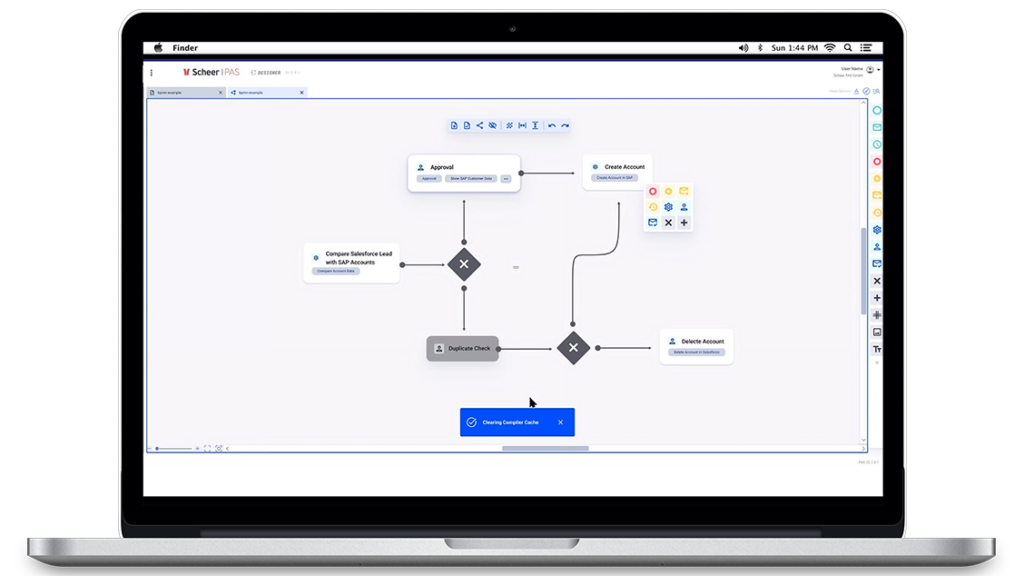

Figure: Scheer PAS platform – from BPMN modelling to a finished application connected to integrated IT systems.

Customer Onboarding and KYC Automation

Loan and Mortgage Application Processing

Fraud Detection and Prevention

Investment and Wealth Management Platforms

Regulatory Compliance and Reporting

Figure: Scheer PAS platform – from BPMN modelling to a finished application connected to integrated IT systems.

Case Study Example:

Large British Private Bank

The Challenge

Complex landscape and interruptions in systems

A large British private bank experienced operational inefficiencies and increased costs due to a non-integrated system landscape and frequent process disruptions. Moreover, poor integration with third-party systems, like payment processors, led to delays and potential revenue losses.

Heterogeneous, non-integrated system landscape

System and media disruptions in business processes

Inadequate connection of payment processing systems or card processors for debit and credit cards

Scheer PAS Implementation

Unified and Integrated IT Systems

Establishment of a central, highly available and load-safe integration platform with which third-party systems can be integrated

Integration and automation of debit and credit card processors

Integration of software for recognition of voice patterns

Solution

Integration

Existing IT landscape with legacy systems

Third-party system integration

Automation

Processing receipt and orders recieved by post

Payment processing with cheques

Innovation

Block cards via online banking / transactions display

Rapid phone service via automatic authentication on vocal base

Flexibility for future requirements of the digital transformation

Investment in security through modernization

Customer

Success Stories

This is what our customers have to say. These are the statements that count!

Trusted by industry leaders:

Explore Scheer PAS Capabilities

Integration

Process Automation

API Management

Application Development

Process Mining and Analytics

Composability

Integration

Process Automation

API Management

Application Development

Process Mining and Analytics

Composability

Get started

Ready to add value to your organisation? Talk to us about it.

Robert Müller

Process Integration Expert

To book a meeting directly with a Scheer PAS expert, you must accept cookies on the Scheer PAS website. For more information about cookie usage, please visit our privacy notice page