What is E-Invoicing?

E-Invoicing refers to the electronic exchange of invoice documents between a supplier and a buyer in a structured digital format, ensuring the automation of invoice processing with minimal manual intervention. E-Invoicing goes beyond merely digitizing paper invoices; it involves the seamless integration of invoice data into financial and accounting systems, ensuring compliance with legal and regulatory standards such as EN 16931. This standard defines the core elements of an electronic invoice, enabling interoperability across EU member states. E-Invoicing is often supported by technologies such as Electronic Data Interchange (EDI), secure data transmission protocols, and digital signatures to guarantee data integrity and authenticity.

E-Invoicing refers to the electronic exchange of invoice documents between a supplier and a buyer in a structured digital format, ensuring the automation of invoice processing with minimal manual intervention. E-Invoicing goes beyond merely digitizing paper invoices; it involves the seamless integration of invoice data into financial and accounting systems, ensuring compliance with legal and regulatory standards such as EN 16931. This standard defines the core elements of an electronic invoice, enabling interoperability across EU member states. E-Invoicing is often supported by technologies such as Electronic Data Interchange (EDI), secure data transmission protocols, and digital signatures to guarantee data integrity and authenticity.

Prepare for the Future

With EU regulations (especially the EN 16931) your enterprise must be future-compliant in order to stay in the race. Starting from 1.1.2025, E-Invoicing is becoming mandatory for the vast majority of enterprise transactions. Official information about EN 16931 can be found here.

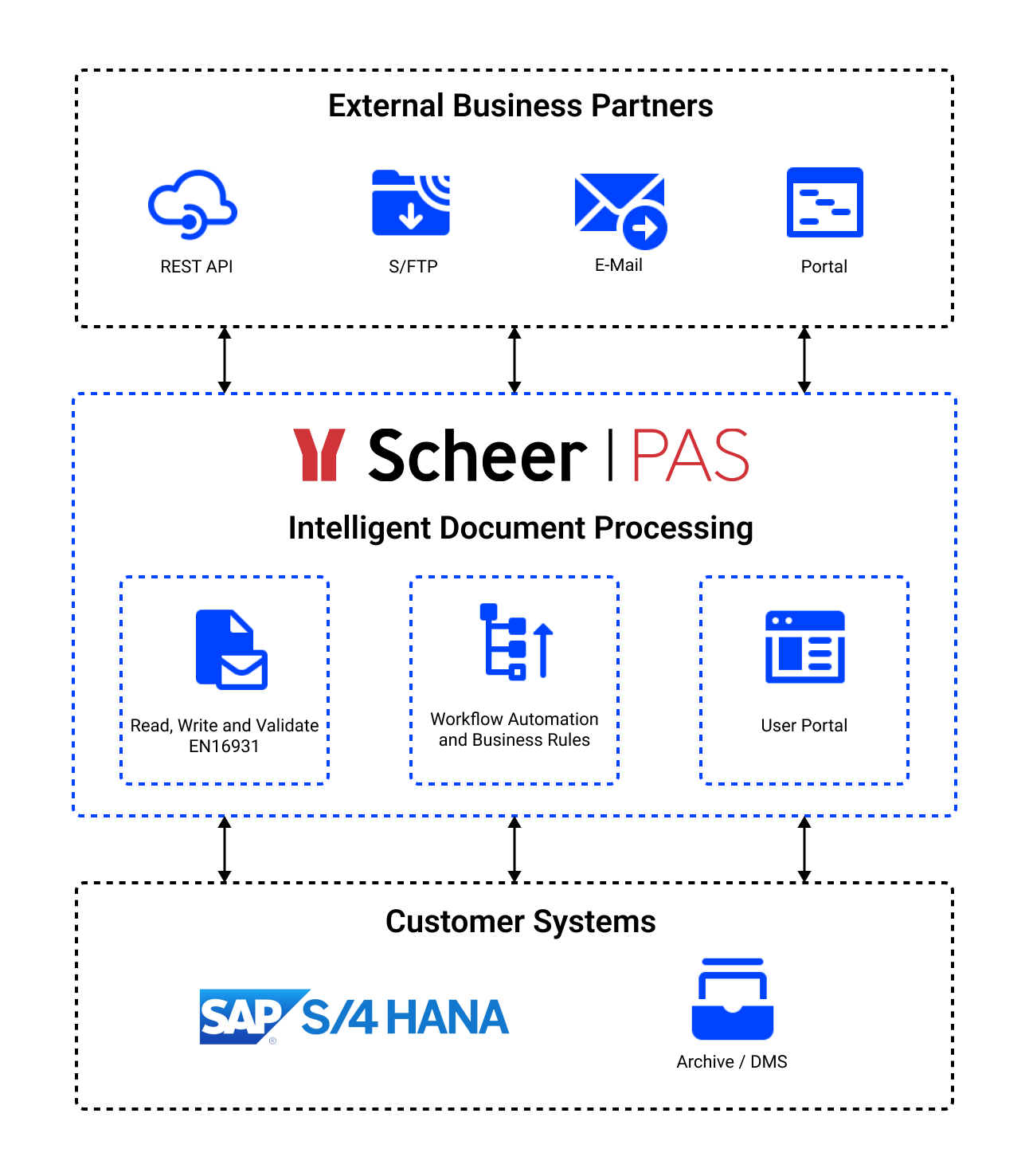

Scheer PAS E-Invoicing Solution

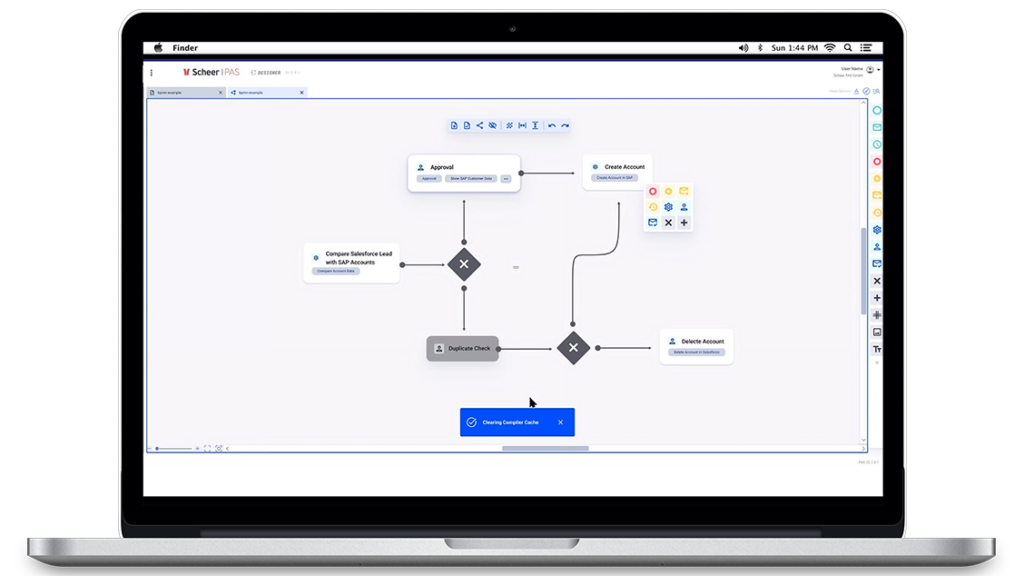

Scheer PAS is fully equipped to manage e-invoicing requirements that are becoming mandatory from 2025 under the EN 16931 standard. It allows businesses to efficiently read, write, and validate machine-readable invoices and orders. By automating these processes, Scheer PAS significantly speeds up invoice processing, reduces errors, and ensures compliance with legal requirements. This capability is increasingly requested by customers and is essential for both Business-to-Government (B2G) and Business-to-Business (B2B) transactions.

XRechnung, ZUGFeRD 2/Factur-X, and ZUGFeRD 1

Pre-Checks with SAP FI/CO/SD/MM/PS/... data

Convert PDF/A1 to PDF/A3

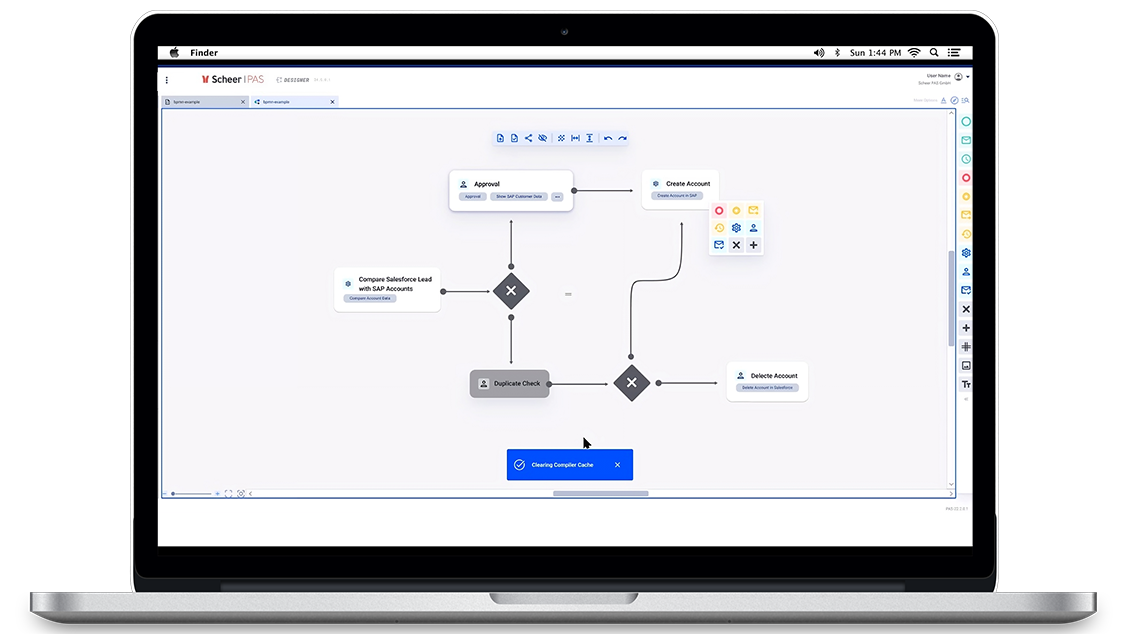

Individual Workflows and Business Rules

Automatic or Manual Authorization and Booking

XRechnung, ZUGFeRD 2/Factur-X, and ZUGFeRD 1

Pre-Checks with SAP FI/CO/SD/MM/PS/... data

Convert PDF/A1 to PDF/A3

Individual Workflows and Business Rules

Automatic or Manual Authorization and Booking

Case Study Example

International Advertising Company

The customer is an international advertising company that builds and promotes brands using creative communication strategies. They develop ideas, campaigns, and brand strategies, providing all the necessary tools for the successful placement of products and brands. This includes conceptualizing visual and user experiences, creating social media content and communication, and developing PR strategies. Additionally, they serve customers in the German public sector (B2G), where e-invoices (XRechnung) have been mandatory since January 2020.

Challenges

Without an ability to handle E-Invoices and a goverment deadline coming up, there was a rising need for a E-Invoicing solution.

Inability to retrieve the E-Invoicing data from internal ERP system

Manual creation of visual representation of invoices

Manual sending of the invoices and manual validation checking

Scheer PAS Implementation

Scheer PAS Intelligent Document Processing

Automatic export of invoice data from internal ERP system

Conversion to XRechnung and validation with KoSIT tools

Automatic creation of HTML visual reports and sending to customers

Results

Successful and reliable generation of XRechnung data since January 2020

Easy and quick error diagnostics using the generated HTML report and their correction in the ERP system for data leading to invalid XRechnung instances

Having employed the official validation tool proved to be a substantial argument in rare cases where the accepting side yielded different validation results using 3rd-party tools

Pricing

E-Invoicing Document Package

From | To | Price | Total p.M. |

1 | 250 | 0,50 | 125 € |

251 | 2.000 | 0,20 | 396 € |

2.001 | 10.000 | 0,17 | 1.740 € |

10.001 | 25.000 | 0,14 | 3.540 € |

25.001 | 75.000 | 0,11 | 8.339 € |

75.001 | 250.000 | 0,09 | 23.039 € |

250.001 | 750.000 | 0,08 | 59.039 € |

750.001 | 2.500.000 | 0,07 | 164.039 € |

From | To | Price | Total p.M. |

1 | 250 | 0,50 | 125 € |

251 | 2.000 | 0,20 | 396 € |

2.001 | 10.000 | 0,17 | 1.740 € |

10.001 | 25.000 | 0,14 | 3.540 € |

25.001 | 75.000 | 0,11 | 8.339 € |

75.001 | 250.000 | 0,09 | 23.039 € |

250.001 | 750.000 | 0,08 | 59.039 € |

750.001 | 2.500.000 | 0,07 | 164.039 € |

Base Package

- EN16931 Validation

- 10 Users

- Free Regulatory Updates

- EU-Cloud Deployment

- Site-to-Site VPN

- Monday-Friday / 09-05 Support

- 99.9% Availability

- 3 Year Contract

Talk to an Expert

To book a meeting directly with a Scheer PAS expert, you must accept cookies on the Scheer PAS website. For more information about cookie usage, please visit our privacy notice page

Customer

success stories

This is what our customers have to say. These are the statements that count!

Get started

Ready to add value to your organisation?

Talk to us about it.

Book a Demo today and witness the transformation of your enterprise!

To book a meeting directly with a Scheer PAS expert, you must accept cookies on the Scheer PAS website. For more information about cookie usage, please visit our privacy notice page