Get Your Enterprise Ready for 2025!

As the end of 2024 approaches and the business engines are starting to reignite after the summer vacations, an important deadline is coming closer as well.

Starting from January 1st 2025, all companies in Germany must be able to receive electronic invoices or E-Invoices.

This is a huge change for most German enterprises that have not yet adapted E-Invoicing or have simply turned to their IT professionals to create a system for manual receiving thus handling this challenge on their own.

Why delay the inevitable?

In-house implementation of a simple E-Invoice receiving system will fulfill the mandatory requirements by the law, but there is another obstacle.

Starting from January 1st 2027, each company with more than 800,000 € turnover will have to use E-Invoicing and not solely receive E-Invoices. A year after that, this rule will apply to companies with less than 800,000 € turnover.

Creating temporary solutions is just creating more and more technical debt.

Prepare for the future

Instead of piling up the technical debt and avoiding the inevitable, why not get a jump start? Intelligent document processing with Scheer PAS enables your enterprise to receive, validate, and send E-Invoices with ease while also automating the process.

Scheer PAS already supports:

- XRechnung

- ZUGFeRD 1

- ZUGFeRD 2/Factur-X

- Automatic or manual authorization and booking

- Creating visual representations of E-Invoices in PDF format

But in order to fully prepare your enterprise for the future, Scheer PAS offers the automatic updates to E-Invoices should the law change their format or specifications.

Scheer PAS E-Invoicing

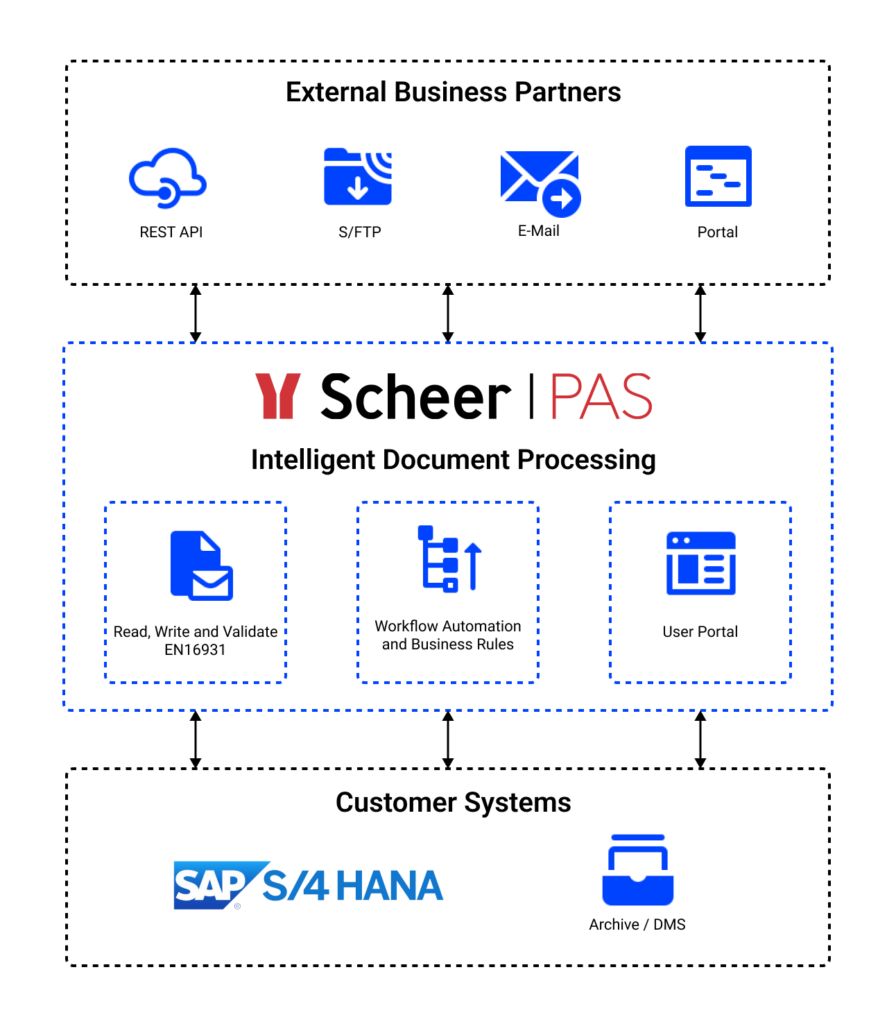

By integrating the IT systems of your partners and customers, Scheer PAS uses intelligent document processing to receive, validate and send E-Invoices with or without any user input depending on their needs.

FAQ

1. Is compliance with the CEN standard EN 16931 guaranteed?

Yes, invoices are validated according to EN 16931.

2. Can the invoice types be recognized automatically?

EN 16931 provides for different invoice types, which are defined using the DocumentTypeCode. An excerpt of the most commonly used DocumentTypeCodes:

– 380 Invoice, partial invoice, final invoice

– 381 Credit note

– 389 Self-billing

– 384 Invoice correction

– 326 Partial invoice

3. Are there discount (skonto) information fields?

The data model of EN 16931 currently does not provide a structured option. However, a corresponding data field has been agreed upon for XRechnung.

4. What happens if an invoice is incorrect? Is there a status report?

The validation detects incorrect invoices and generates an error report, indicating exactly where the error is. Status notifications can be sent to the sender via email.

5. Can invoices be matched against SAP orders?

Yes, through the process engine and the integration with SAP, individual workflows and pre-approval steps can be defined with a user interface.

6. Can individual line items be read out?

Yes, line item data is integrated in the e-invoice.

7. Can a PDF/A3 for reading and archiving be generated from an e-invoice/XML?

Yes, to facilitate implementation, a PDF including the XML file can be generated from the incoming XML, and for example, sent via email to an internal mailbox.

This PDF can be forwarded to an archiving system for further archiving, fulfilling GoBD compliance.

8. Can e-invoices be generated?

Yes, e-invoices can be generated and sent via email.

9. Which target systems are supported?

In general, all technical IT systems can be connected. Common ones include email mailboxes, SAP, file spaces, DMS, and archiving systems or REST APIs.

10. What happens if legal regulations change? Does the solution need to be manually updated?

In the event of legal changes, e.g. in validation, we provide an update, which is included in the price.

Future standards, such as the EU VAT in the Digital Age (ViDA) standard, will be included in this solution.

11. How much effort is required for implementation?

It depends on how complex the respective workflows are. This can be estimated individually.

Processing e-invoices and sending them back as PDFs to a mailbox takes about 2-3 person days, including platform setup and testing.

Pricing

Base Package

- EN16931 Validation

- 10 Users

- Free Regulatory Updates

- EU-Cloud Deployment

- Site-to-Site VPN

- Monday-Firday / 09-05 Support

- 99.9% Availability

- 3 Year Contract

399 € / month (+VAT)

+

| From | To | Price | Total p.M. |

| 1 | 250 | 0,50 | 125€ |

| 251 | 2.000 | 0,20 | 396€ |

| 2.001 | 10.000 | 0,17 | 1.740€ |

| 10.001 | 25.000 | 0,14 | 3.540€ |

| 25.001 | 75.000 | 0,11 | 8.339€ |

| 75.001 | 250.000 | 0,09 | 23.039€ |

| 250.001 | 750.000 | 0,08 | 59.039€ |

| 750.001 | 2.500.000 | 0,07 | 164.039€ |

That’s just the beginning

Handling E-Invoices with the upcoming deadline should be a number one priority for any German enterprise. Tackling this challenge with Scheer PAS will open up new possibilities for seamless modernization and digitalization of your enterprise.

Therefore, prepare for the future and handle E-Invoices with Scheer PAS. With just one click, get a free personalized Demo at any time slot which fits you best where you will get:

- Demo of Scheer PAS E-Invoicing

- Free consultation with our experts

- Free content package (webinar and 2 interesting case studies)

Get your Demo

Setup an appointment with our team of experts at your convenience and get a personalized Demo of E-Invoicing tailored to your enterprise’s needs.